Diana Mousina

On the surface, some figures suggest property prices haven’t been taken a huge hit from COVID-19, while others suggest a short-term collapse. For us, it’s the fundamentals which have always impacted property prices that hold the likely answers.

CoreLogic data from April showed Australian capital city dwelling prices rose by 0.2%. This follows a 10.2% decline over 21 months to June last year, and means average prices have now had their tenth rise in a row.

A superficial glance would suggest property prices haven’t been too hard hit by COVID-19. However, it’s important to remember that there is a lag in data, and we will start to see the true impact in the coming weeks and months.

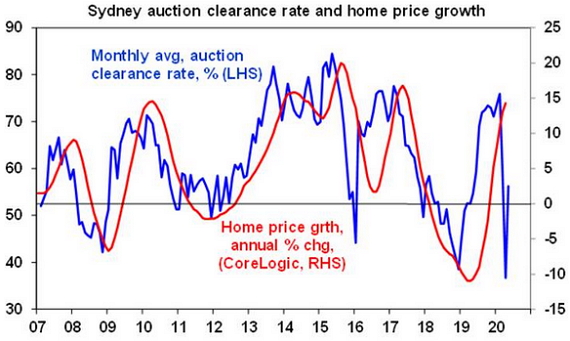

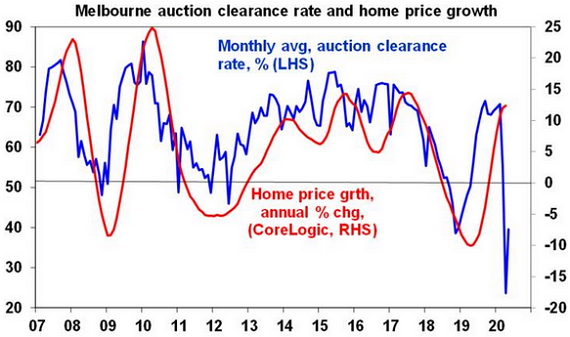

One of the clues to what the short and mid-term holds for property prices is auction clearance rates. Data is signalling a fall is ahead, as you can see from the charts below. These guides aren’t as reliable as normal due to the unprecedented restrictions with social distancing, but they still provide an indication of how auction clearance rates and home price growth can correlate. Note that data released this week indicates a spike – for the week ending May 9, Sydney recorded a clearance rate of 65.4% and Melbourne recorded 46.7%. These figures are still below average, but not as drastically below average than previous weeks.

Sources: Domain, CoreLogic, AMP Capital

Sources: Domain, CoreLogic, AMP Capital

We can now see the government intends to start re-opening dormant parts of the economy in the next two months. Physical inspections and auctions across Australia should gradually phase in as a result. While this is a welcome sign of activity, there are other factors to consider which have historically driven property prices in capital cities, especially in Sydney and Melbourne.

For one, a stop to immigration (in the absence of a vaccine) is likely to persist beyond the gradual lockdown lift. For now, prime minister Scott Morrison has marked restrictions on international travel as one of the last things to ease.1 Immigration is a strong contributor to house price growth in Australia. Just a few months ago, for example, a study found immigration can boost Australian house prices by as much as $6,500 per year.2

Further, a sharp rise in unemployment to approximately 10% and rent holidays/reductions point to property demand falling more than supply. This is a critical equation, and currently, it poses a big threat to property prices.

The outlook so far

If the domestic lockdown starts to be eased through this month, as has been announced, our base case is we expect then the fall in average property prices is likely to be around 10%, as the six-month wage subsidies and bank payment deferrals will have been long enough to protect the economy and hence the property market. In effect, this would just take prices back to where they were around the middle of last year.

It’s important to note the above figures would likely mask 10% to 15% price falls in Sydney and Melbourne, compared to 5% falls in other cities. These cities are more vulnerable due to much higher debt levels, higher home prices and a greater dependence on immigration.

There are many ways to slice and dice the figures, but the fundamentals remain the important things to watch, especially and as always, supply and demand.

1 https://www.abc.net.au/news/2020-05-08/international-travel-still-banned-coronavirus-restrictions/12229114

2 https://www.domain.com.au/news/immigration-boosts-australian-house-prices-by-as-much-as-6500-a-year-study-924112/

Author: Diana Mousina, Economist – Investment Strategy & Dynamic Markets, Sydney Australia

Source: AMP Capital 13 May 2020

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.