– but is it sustainable?

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Key points

-

Bonds and shares often diverge – we saw this a year ago with shares rallying but bond yields staying low.

-

Shares have been boosted by strong earnings news, improved valuations, investor awareness of last years’ experience of a post lockdown bounce back, vaccines providing optimism in a more sustained reopening, some pressure for more stimulus & M&A activity.

-

While shares remain vulnerable to a correction, the trend is likely to remain up.

Introduction

Despite lots of worries – around the resurgence of coronavirus driven by the Delta variant, peak growth, peak monetary and fiscal stimulus and high inflation – global and Australian shares are around record levels. So how can this be? Particularly with bond yields down sharply from their highs earlier this year. And how sustainable is it? And what are the risks?

Bond yields down

On the face of it, shares and bonds seem to be telling us a different story. Since their highs earlier this year, ten-year bond yields have fallen 0.5% in the US to 1.26%, 0.4% in Germany to -0.47% and 0.7% in Australia to 1.16%. The decline in bond yields appears to reflect several factors:

-

Increased confidence that the spike in inflation is mainly being driven by pandemic and reopening related distortions and so will be transitory. July US core CPI slowed more than expected and while producer price inflation is high, the flow through to consumer price inflation is weak with core inflation around 1% or less in Europe, China and Japan. And in Australia, June quarter inflation was relatively benign.

-

Fears that the rise in Delta coronavirus cases globally might badly derail the economic recovery – with China seeing its toughest restrictions since early last year, rising US cases driving sharply lower consumer confidence and Australia seeing extended and new lockdowns as cases rise.

-

Concern we have seen the best in terms of economic growth, regardless of coronavirus outbreaks.

-

Ongoing central bank bond buying (or QE).

-

A slowing in the supply of bonds in the US as the US Treasury has been issuing less bonds due to a lower budget deficit and as the debt ceiling has been reached.

-

A short covering rally – as those who have been short or underweight have been forced by the bond rally to buy back into them which in turn pushes bond yields even lower.

But shares have been trending up

But while it may seem perplexing, and I must admit that I have been seeing shares as vulnerable to a correction, there are good reasons behind the strength in shares:

-

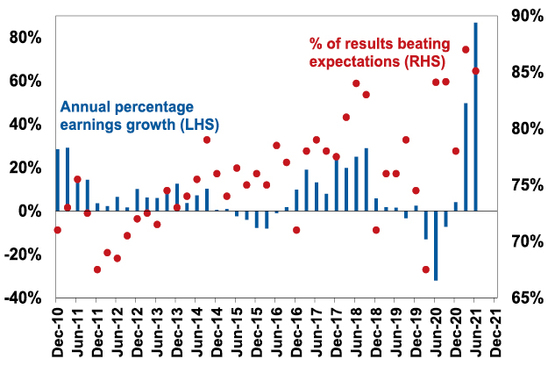

First, earnings news has been strong. The June quarter earnings reporting season in the US is now largely complete with 85% of companies beating on earnings (compared to a norm of around 76%), 83% beating on revenue and earnings up by around 87% on the June quarter last year compared to market expectations for a 62% rise. In other words, US earnings have come in around 15% higher than expected. And it’s been basically the same story globally.

US earnings growth and beats

Source: Bloomberg, AMP Capital

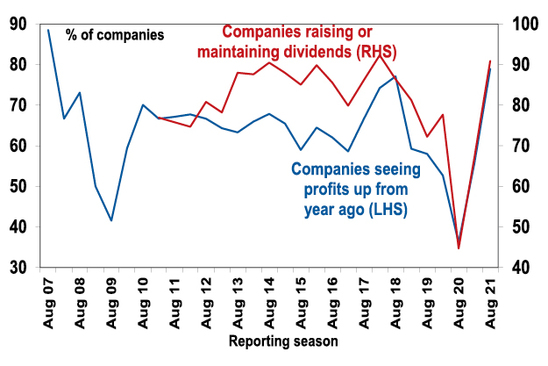

Similarly, in Australia. While it’s still early in the June half earnings reporting season, results so far have been stronger than expected with 79% of companies reporting earnings up on a year ago and a large return of capital to shareholders via increased or reinstated dividends and buybacks.

Proportion of Australian companies seeing profits up and raising or maintaining dividends

Source: AMP Capital

-

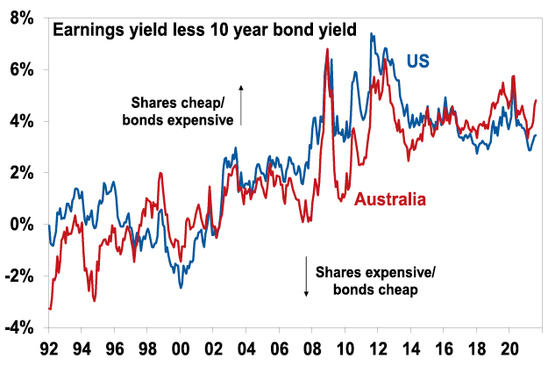

Second, the rebound in company earnings has seen price to earnings multiples decline from recent highs despite the strength in share markets this year, resulting in higher earnings yields. At the same time, the decline in bond yields has increased the risk premium shares offer over bonds – as proxied by the earnings yield less the bond yield. In other words, shares have become more attractive.

Shares have become a bit cheaper versus bonds

Source: Thomson Reuters, AMP Capital

-

Third, last years’ experience in Australia and in other countries more recently (eg Europe after a double dip recession earlier this year) – showed that once lockdowns end, the economy bounces back strongly. This is partly because fiscal support protects businesses, jobs and incomes and combines with ultra-easy monetary policy to see pent up demand unleashed far more quickly than would occur coming out of a normal downturn. So having learned the lesson from last year where many investors got wrong footed (selling shares driving a roughly 35% decline only to then have to quickly buy them back or miss out) investors are keen not to make the same mistake again.

-

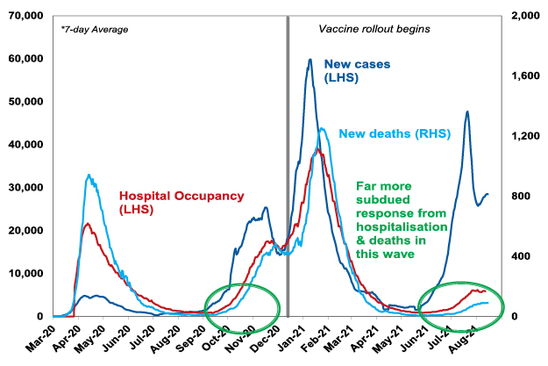

Fourth, in contrast to the first lockdowns early last year, vaccines are now providing confidence that more heavily vaccinated countries will continue to recover and that Australia will see a more sustained recovery from later this year. The experience with vaccines in more heavily vaccinated countries is that they are working. They are less effective in preventing infection from new variants like Delta (at 60% plus) and onward transmission which is challenging whether “herd immunity” can ever be achieved. But they are highly effective in preventing the need for hospitalisation (85% plus) and death (90% plus). So if a sufficient proportion of the population is vaccinated hospitalisations and deaths won’t surge with new cases and we can learn to live with coronavirus without overwhelming the healthcare system. The UK is a good test case in relation to this and so far, so good with hospitalisation and deaths remaining far more subdued than seen in previous outbreaks.

UK: New Coronavirus Cases, Hospitalisation and Deaths

Source: ourworldindata.org; AMP Capital

The US faces greater risks with some states seeing their hospital systems getting stretched to the limit but this appears to reflect their low vaccination rates. The lowest 25% of US states by vaccination are seeing 3 times the number of new cases per capita, 4 times the number of hospitalisations and 7 times the number of deaths compared to the top quartile of states by vaccination. But apart from some restrictions there appears to be little inclination to return to lockdowns so long as vaccines continue to work.

Australia’s vaccination rate has surged to 1.6 million doses a week with 39% of the whole population having had one dose and 21% two doses. If sustained, this means that the target for 70% of the adult population to be vaccinated should be met by mid-October, 80% of the adult population by early November and 80% of the whole population – which will likely be needed – in December. If this is correct then Australia should be able to more sustainably start relaxing and then exiting lockdowns from later this year. Of course, this will likely mean even higher daily coronavirus numbers but as long as they don’t overwhelm the hospital system we should be able to live with it. (Of course, the unvaccinated will remain at high risk.)

-

Fifth, while we may have seen peak stimulus – the Delta outbreak is reinforcing pressure for more fiscal stimulus in the US & while it has not seen the RBA reverse its decision to start tapering its bond buying next month it has pushed out our expectation for the first rate hike to late 2023.

-

Finally, some may be expecting more M&A activity given the low cost of borrowing.

Key risks

The key risks are that:

-

The Delta variant or similar necessitates much higher levels of vaccination than most governments are assuming. This in fact appears quite likely but would just delay reopening a bit – as noted above Australia should be able to reach 80% of the whole population vaccinated by year end at the current rate, although this may require some carrot and stick.

-

A new coronavirus variant mutates and is able to get around the defences provided by current vaccines in terms of serious illness. Lambda which originated in Peru last year is of some concern but does not seem to have spread much.

-

The inflation spike proves not to be transient. More supply side disruptions are likely (eg from the restrictions in China) and this could keep inflation elevated for longer. This would ultimately mean faster central bank monetary tightening and higher bond yields which would weigh on equity valuations.

-

A US fiscal scare – in the near term this is a risk in relation to the need to increase the debt ceiling by around October (with a showdown now looking likely) and tax hikes on high income earners, profits, capital gains and dividends. The former could mean a short-lived scare but with both sides ultimately cooperating as they don’t want to get the blame for having a US default, but the tax hikes are a bigger risk.

-

Political tensions with China or tighter than necessary policy resulting a sharply Chinese slowdown in the near term.

Outlook

While shares remain at high risk of a short-term correction – potentially triggered by the above-mentioned risks – we ultimately see the rising trend continuing and bond yields trending up again once it’s clear that economic recovery will continue despite the disruption from Delta. Peak GDP and earnings are far more important than peak growth in either and both look to be a long way off given that the excesses that normally lead to peaks in both – a lack of spare capacity, a sustained rise in inflation and central banks jamming the brakes on – are still mostly absent.

A divergence between shares and bonds is not that unusual – in fact, much consternation was expressed about the same a year ago. Ultimately shares prevailed as investors looked beyond prevailing uncertainties and bond yields eventually rose. As long as the market can look beyond current uncertainties to something better, then it will.

Source: AMP Capital August 2021

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.