Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

-

Australian election campaigns tend to result in a period of uncertainty which have seen weak gains on average for shares followed by a bounce once it’s out of the way.

-

Labor is not offering a significantly different economic policy agenda than the Coalition. With the exception of climate policies, it’s hard to see a significant impact on investment markets from a change in government. A bigger risk would come from a hung parliament.

-

To return to decent and sustained real wage gains requires a productivity enhancing reform agenda. This election is unlikely to deliver much on this front.

The Australian Federal Election

The Federal political landscape has become somewhat less stable since the 2007 election with six changes in PM, “minority government” at times and a rise in the importance of independents. This has made sensible visionary long-term policy making harder. The last three and a half years have seen a bit more stability though with Scott Morrison being the longest servicing prime minister since John Howard. Policy uncertainty going into the 21 May election is lower than in 2019 as Labor is not offering starkly different policies to the Coalition this time.

Polls and betting markets

Polls give Labor a two-party preferred lead of around 54% to 46%, although the ALP’s primary support appears to have softened a bit since the election was called. Of course, overall polling needs to be interpreted cautiously as the ALP was ahead going into the 2019 election only to see the Coalition win. As my Canberra based colleague Al Kinloch points out, around 20% of people decide on election day and they often stick to what they know. It’s also less clear in the marginal seats which is what counts. Betting markets give roughly equal odds to both.

Elections, the economy & markets in the short term

There is anecdotal evidence that uncertainty around elections causes households and businesses to put some spending on hold. However, hard evidence of this is mixed and there is no clear evidence that election uncertainty effects economic growth in election years. In fact, since 1980 economic growth through election years averaged 3.5% which is greater than average growth of 3% over the whole period.

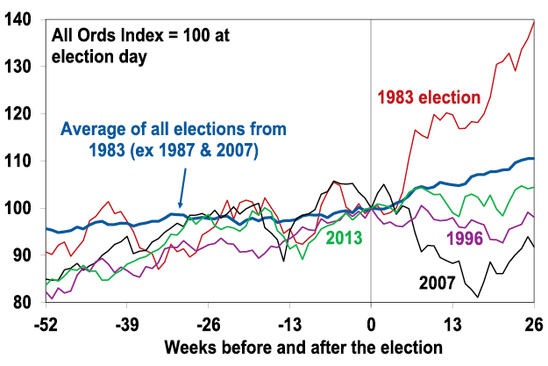

In terms of the share market, there is some evidence of it tracking sideways in the run up to elections, which may be because of uncertainty. The next chart shows Australian share prices around federal elections since 1983. This is shown as an average for all elections (but excluding the 1987 and 2007 elections given the 1987 global share crash and the start of the GFC in 2007), and the periods around the 1983 and 2007 elections, which saw a change of government to Labor, and the 1996 and 2013 elections, which saw a change to the Coalition. The chart suggests some evidence of a period of flat lining in the run up to elections followed by a relief rally.

Australian equity market around election days

Source: Reuters, Bloomberg, AMP

However, the elections resulting in a change of government have seen a mixed picture. Shares rose sharply after the 1983 Labor victory but fell sharply after their 2007 win, with global developments playing a role in both. After the 1996 and 2013 Coalition victories shares were flat to down. So based on history it’s not obvious that a victory by any one party is best for shares in the immediate aftermath, and historically moves in global shares played a bigger role than the election outcome. The next table shows that 10 out of the 14 elections since 1983 saw shares up 3 months later with an average 4.5% gain.

Australian shares before and after elections

|

Election |

Winner |

Aust shares, % chg 8 weeks up to election |

Aust shares. % chg 3 mths after election |

|

Mar 1983 |

ALP |

-0.6 |

19.8 |

|

Dec 1984 |

ALP |

0.0 |

5.4 |

|

Jul 1987 |

ALP |

3.7 |

15.9 |

|

Mar 1990 |

ALP |

-7.0 |

-3.5 |

|

Mar 1993 |

ALP |

9.0 |

3.2 |

|

Mar 1996 |

Coalition |

2.3 |

-2.0 |

|

Oct 1998 |

Coalition |

-2.6 |

11.1 |

|

Nov 2001 |

Coalition |

5.9 |

5.4 |

|

Oct 2004 |

Coalition |

5.9 |

9.9 |

|

Nov 2007 |

ALP |

-2.9 |

-11.7 |

|

Aug 2010 |

ALP |

0.5 |

5.7 |

|

Sep 2013 |

Coalition |

4.6 |

-1.0 |

|

Jul 2016 |

Coalition |

-0.6 |

4.5 |

|

May 2019 |

Coalition |

2.9 |

0.4 |

|

Average |

|

1.5 |

4.5 |

Based on All Ords price index. Source: Bloomberg, AMP

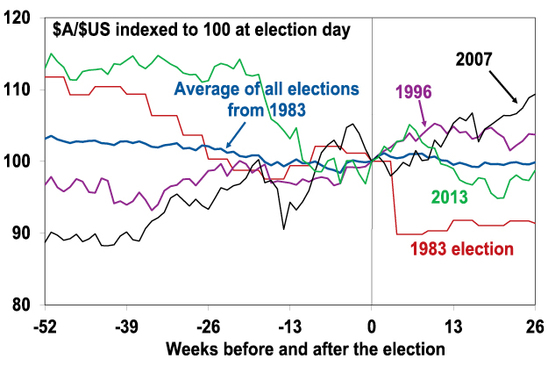

The next chart shows the same analysis for the Australian dollar. In the six months prior to Federal elections there is some evidence the $A experiences a period of softness and choppiness, which is consistent with policy uncertainty, but the magnitude of change is small. On average, the $A has drifted sideways to down slightly after elections, but it’s very messy.

Australian dollar around election days

Source: Reuters, Bloomberg, AMP

Shares & property under Coalition & ALP governments

Over the post-war period shares have returned (capital growth plus dividends) 13% pa under Coalition governments and 10% pa under Labor governments. It may be argued that the Labor governments led by Whitlam in the 1970s and Rudd and Gillard had the misfortune of severe global bear markets. And the economic rationalist and reformist Hawke/Keating government defied conventional perceptions that conservative governments are better for shares. Over the Hawke/Keating period from 1983 to 1996 Australian shares returned 17.2% pa.

Looking at the Australian residential property market, using CoreLogic data since 1980, capital city property prices have risen 6.6% pa under Coalition governments and 5.2% pa under Labor. That said, policies with respect to housing have not been particularly different under both sides of politics.

Once in government, political parties are usually forced to adopt sensible policies if they wish to ensure rising living standards and arguably there has been broad consensus in recent decades regarding key macro-economic fundamentals – eg, low inflation and free markets. So ultimately economic and interest rate cycles have a dominant impact on investment markets rather than specific policies under each government.

Economic policy differences in this election

The policy differences this time around are a non-event compared to the more left-wing reconstruction Labor proposed in the 2019 election, which offered the starkest choice seen since the 1970s. In the 2019 election, the ALP offered a radically different policy agenda focussed on a significant increase in the size of government (particularly via more spending on health and education) financed by a significant increase in taxation. The latter included a 2% tax increase for high income earners, restricting negative gearing to new residential property, halving the capital gains tax discount, stopping cash refunds for excess franking credits and a 30% tax on distributions from discretionary trusts. Following its defeat at that election, with the tax agenda taking much of the blame, the ALP has adopted a less left leaning agenda going into this election.

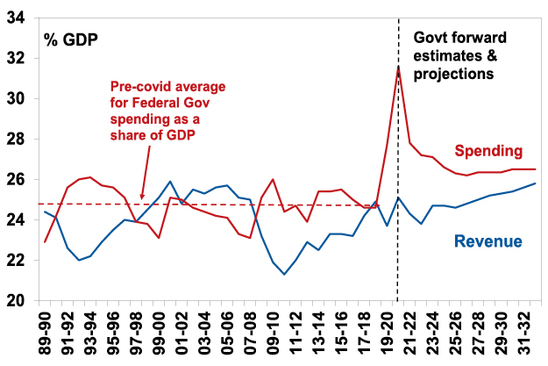

Oddly enough we have ended up with bigger government anyway with a huge surge on the back of pandemic spending and the March Budget projecting that Federal spending will settle at around 26.5% of GDP from 2025 onwards due to higher spending on health, the NDIS, the aged and defence. This is well above the pre-covid average of 24.8%. In the meantime, the budget deficit is much higher, even after pandemic spending is wound down.

Federal Government spending and revenue

Source: Australian Treasury, AMP

There are some economic policy differences. Labor is likely to:

-

Be more interventionist in the economy.

-

Boost public services including childcare and the aged.

-

Introduce “portable” entitlements for workers in insecure jobs funded by a levy on employers, whereas the Coalition remains committed to its blocked industrial relations reform bill from last year aimed at revitalising enterprise bargaining.

-

Allow the tax to GDP ratio to rise above the Coalition’s self-imposed 23.9% limit and to rely even more on this to reduce the budget deficit, even though it’s committed not to increase taxes or introduce new taxes other than increased tax on multinationals. By contrast, once the cap is reached the Coalition would have to focus more on spending cuts.

-

Tighten decarbonisation commitments with a faster reduction in emissions by 2030 – with a 43% cut below 2005 levels compared to a 26-28% cut under the Coalition.

However, these differences are relatively minor compared to the policy platform offered by Labor in 2019. The similarities are more noticeable. Like the Coalition, the ALP is largely seeking to repair the budget through economic growth rather than austerity and its priority areas of energy, skills, the digital economy, childcare & manufacturing have a significant overlap with the Coalition. So, while there may be a little more nervousness in investment markets about Labor, it’s hard to see a big impact on markets if there is a change in government.

Challenges for the next government

The main economic challenges the winner will face include:

-

Getting the budget deficit back under control – the Budget does not see a return to surplus for the next decade at least. At some point, tough decisions will be needed to either reduce spending or raise taxes as a share of GDP.

-

Boosting productivity growth – this has been flagging as the payoff from the 1980s to early 2000s reforms wane. Without productivity enhancing reforms, it’s hard to see it averaging the 1.5% pa implied in longer-term Budget assumptions. This will mean waning growth in living standards, possibly even higher inflation and weak real wages growth. Neither side is proposing significant productivity enhancing reforms in key areas like tax, education, industrial relations and competition.

-

Housing affordability – this has been deteriorating for two decades, impacting productivity and intergenerational & income equity. But serious reforms to address it are lacking.

Concluding comment

The relatively modest difference in economic policies between the Coalition and Labor suggests minimal impact on investment markets if there is a change of government. The main risk for investment markets may come if neither the Coalition or Labor win enough seats to govern, forcing a reliance on minor parties or independents, which could force a new government down a less business friendly path (such as the Greens demanding an ALP led minority government implement their proposed super profits taxes) – although the Senate may act as a brake on this.

Source: AMP Capital April 2022

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.