– balancing a revenue windfall, election promises, structural spending demands & inflation pressures

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Diana Mousina – Senior Economist, AMP Capital

Introduction

The Government has implemented its election policies and expects lower budget deficits this year and next thanks to another revenue windfall and various savings. Future years show a significant deterioration though as structural spending pressures, higher interest rates and lower productivity growth impact. As the Treasurer foreshadowed, this is largely a “bread and butter” budget though with significant reform left for next year’s budget.

Key budget measures

Key measures in the Budget mainly reflect election promises:

-

Increasing the childcare subsidy rate and expanding eligibility.

-

Extending paid parental leave to 6 months with widened eligibility.

-

More for Medicare, aged care, health, the NDIS and defence.

-

Cheaper PBS drugs by cutting the co-payment to $30 from $42.50.

-

Tax incentives for electric cars.

-

Reinvigorating workplace bargaining to lift wages in low-income jobs.

-

Increased spending on TAFE and more university places.

-

Increased infrastructure spending although this had already largely been budgeted with some funds “re-profiled”.

-

Increased aid for the Pacific and South-East Asian countries.

-

Various housing support measures – setting up a new Housing Accord to build 1 million new homes over 5 years, a Help to Buy equity scheme for 10,000 first home buyers, super concessions for downsizers over 55, the establishment of a National Housing Supply and Affordability Council, $350m in Federal Funding to help incentivise institutional (including super fund) investment in delivering an extra 10,000 affordable homes.

-

The start-up of various “off budget funds” – a $10bn fund to build 30,000 affordable homes, a $20bn fund to boost renewable electricity infrastructure and a $15bn National Reconstruction Fund.

Budget savings include the following:

-

A cut in public sector spending on consultants, travel & labour hire.

-

Cuts to regional infrastructure funds & community grants.

-

A crackdown on tax avoidance.

-

Increased tax on multinationals.

The Government has deferred any decision on the Stage 3 2024 tax cuts.

Economic assumptions

Since the March Budget there has been a significant deterioration in the outlook reflecting high price and cost pressures (not helped by the war in Ukraine and natural disasters), aggressive monetary tightening in response and falling real wages. As a result, the Government has revised up its inflation forecasts to allow for a slower decline through next year (although it still sees a peak this year at 7.75%), downgraded its GDP growth forecast for 2023-24 to just 1.5% mainly due to weaker consumer spending and revised up its unemployment forecast for mid 2024 to 4.5%. We are a bit more optimistic on the speed with which inflation will fall next year.

The Federal Government now sees net immigration rising to 235,000 this financial year and continuing at this trend, which is back to pre-pandemic levels. The Government pushed out its $US55/tonne iron ore price assumption to March quarter 2023. With iron ore now around $US95/tonne, it remains a source of revenue upside.

Economic assumptions

|

|

|

2021-22 |

2022-23 |

2023-24 |

2024-25 |

2025-26 |

|

Real GDP |

Govt |

3.9 |

3.25 |

1.5 |

2.25 |

2.5 |

|

% year |

AMP |

|

3.4 |

1.6 |

2.5 |

2.5 |

|

Inflation |

Govt |

6.1 |

5.75 |

3.5 |

2.5 |

2.5 |

|

% to June |

AMP |

|

5.6 |

2.8 |

2.7 |

2.5 |

|

Wages, |

Govt |

2.6 |

3.75 |

3.75 |

3.25 |

3.5 |

|

% to June |

AMP |

|

3.6 |

3.5 |

3.2 |

3.25 |

|

Unemp Rate |

Govt |

3.8 |

3.75 |

4.5 |

4.5 |

4.25 |

|

% June |

AMP |

|

4.0 |

4.2 |

4.2 |

4.25 |

Source: Australian Treasury, AMP

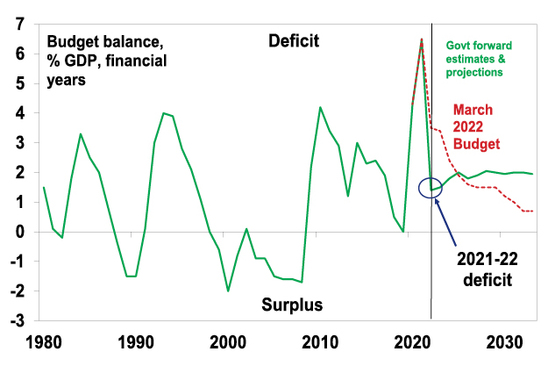

Budget deficit projections

The Government’s revised budget projections are shown in the next table. Despite increased spending, mostly associated with election promises, the deficit projections are lower for this year and next than in March. This is mostly due to another budget windfall from higher commodity prices, lower unemployment for now & higher inflation – which boosts revenue relative to spending (see the line called “parameter changes”). This was the main driver of the 2021-22 deficit coming in at $32bn rather than the $80bn back in March. It’s reduced the deficit by $42.2bn this year and $11.7bn next. Also helping are that any new spending measures are largely offset by budget savings such that “new stimulus” this year is just $1.1bn and next year there is no new stimulus. As a result, the expected deficit for this year has fallen to $36.9bn and for next year to $44bn (from $78bn and $56.5bn back in March). This lack of extra significant stimulus when inflation pressures are strongest is economically responsible.

However, from 2024-25 onwards the projections for the budget deficit have worsened relative to March reflecting a combination of an assumption that commodity prices revert to more “realistic” levels, a lower long run productivity growth assumption of 1.2%pa (down from 1.5%pa) which lowers growth in the tax base and greater allowance for structural spending pressures – on the NDIS, aged care, health, defence and interest costs, but mainly the NDIS.

Underlying cash budget balance projections

|

|

2021-22 |

2022-23 |

2023-24 |

2024-25 |

2025-26 |

|

Mar 21-22 Budget, $bn |

-79.8 |

-78.0 |

-56.5 |

-47.1 |

-43.1 |

|

Parameter chgs, $bn |

|

+42.2 |

+11.7 |

-2.2 |

+0.8 |

|

New stimulus, $bn |

|

-1.1 |

+0.7 |

-2.0 |

-7.4 |

|

Projected budget,$bn |

-32.0 |

-36.9 |

-44.0 |

-51.3 |

-49.6 |

|

% GDP |

-1.4 |

-1.5 |

-1.8 |

-2.0 |

-1.8 |

Source: Australian Treasury, AMP

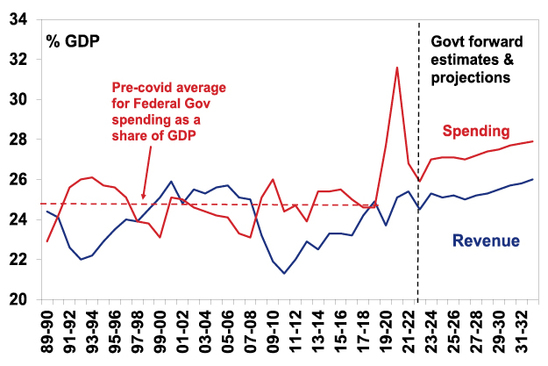

As in the last few budgets, projections for spending as a share of GDP have shifted higher again & are now expected to average 27.1% of GDP over the next three years before rising to 28% of GDP by 2023-33, up from the pre-covid average of 24.8%. This reflects structural pressure from health, aged care, the NDIS, defence and interest costs. Revenue is still assumed to rise with a growing economy – even with the Stage 3 tax cuts – but is no longer assumed to be enough to close the gap with spending.

Federal Government spending and revenue

Source: Australian Treasury, AMP

So the budget deficit is now projected to be stuck at 2% into next decade.

Australian Federal budget deficit

Source: Australian Treasury, AMP

Due to the lower budget deficit in the next two years and higher nominal GDP, gross public debt is now projected to be lower as a share of GDP than previously projected for the next four years. However, the $1trillion level is still expected to be reached next year. And the worse medium term deficit projections now see public debt looking worse into next decade.

Australian Federal gross debt

Source: RBA, Australian Treasury, AMP

Assessment

Winners include: parents; students; medicine users; patients; electric car buyers; NBN users; aged care residents; pensioners; new home buyers; skilled migrants; neighbouring countries; electric car buyers; and the environment. But unlike in the March Budget there are more losers this time including: multinationals; tax avoiders; foreign investors; Federal law breakers; and consultants, contractors & travel agents to the public sector.

The Budget has a bunch of things to commend it:

-

For this year and next it has largely saved the revenue windfall, resulting in a decline in the deficit to $36.9bn for this year and to $44bn next year (from the $78bn and $56.5bn expected in March). Because there is no significant new stimulus this year and next fiscal policy won’t add to inflation when it is highest and make the RBA’s job harder. As such there is no Trussonomics here!

-

Spending measures are aimed at boosting workforce participation (child care & parental leave) and productivity (infrastructure and skills measures) which may help boost the supply side of the economy.

-

There has been a realistic attempt to highlight the structural pressure on the budget, the economic assumptions look reasonable and public debt remains low compared to other comparable countries. This should see the Government retain its triple A credit rating.

- Commodity price assumptions remain well below current levels and so could be a source of downside surprise for the deficit.

-

The new Government is focussing more on boosting the supply of housing to help improve affordability, rather than just on demand which only makes the problem worse. The challenge is that much of the supply boost begin until from 2024 and in the meantime underlying demand for housing is already rising with immigration ramping up.

However, the Budget presents a significant long-term challenge with yet another ramp up in structural spending (reflecting increasing demands on the public sector) with a little in the way of major spending offsets and a continuing reliance on rising revenue to at least stop the situation worsening. As such it still leaves significant deficits in place for the next decade at least, leaves the budget vulnerable should anything come along to curtail the commodity boom and runs the risk that the ever expanding government share of GDP further slows productivity growth over the medium term. At some point tough decisions are required to cap spending growth or further raise tax revenue, hopefully in a way that does not crimp productivity growth. This remains an issue for the next budget.

Implications for the RBA

The good news is that the Budget, with its lower deficits this year and next, won’t add to inflationary pressure in the near term and so won’t add to RBA rate hikes. We expect another 0.25% rate hike next week and the cash rate to peak at 2.85% with a risk case of 3.1%.

Implications for Australian assets

Cash and term deposits – cash returns remain low but are improving thanks to RBA rate hikes.

Bonds – ongoing budget deficits add to upwards pressure on bond yields, but at least they have been lowered in the near term so there should be no new upwards pressure on bond yields from this source. Longer term the budget deficits present more of a challenge though.

Shares – the budget is positive for childcare and construction companies but beyond that there is not really a lot in it for the share market.

Property – the confirmation of more homebuyer schemes and more immigrants offset by long term housing supply measures are unlikely to alter the dominant negative impact of rising mortgage rates in driving a cyclical downturn in home prices.

The $A – the Budget is unlikely to change the direction for the $A.

Source: AMP Capital October 2022

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.